2. Above a floor of minimum untaxed income, set the personal income tax at 19% for families with children. The rate for singles and couples without children will be slightly higher. The tax will be the same on all forms of income, with no deductions for mortgages, charities, depreciation, etc. Those with high incomes will not be able to shelter their income, and everyone should have more money to spend. This will be the first step toward simplifying taxes and significantly reducing the IRS.

FREE E-Book

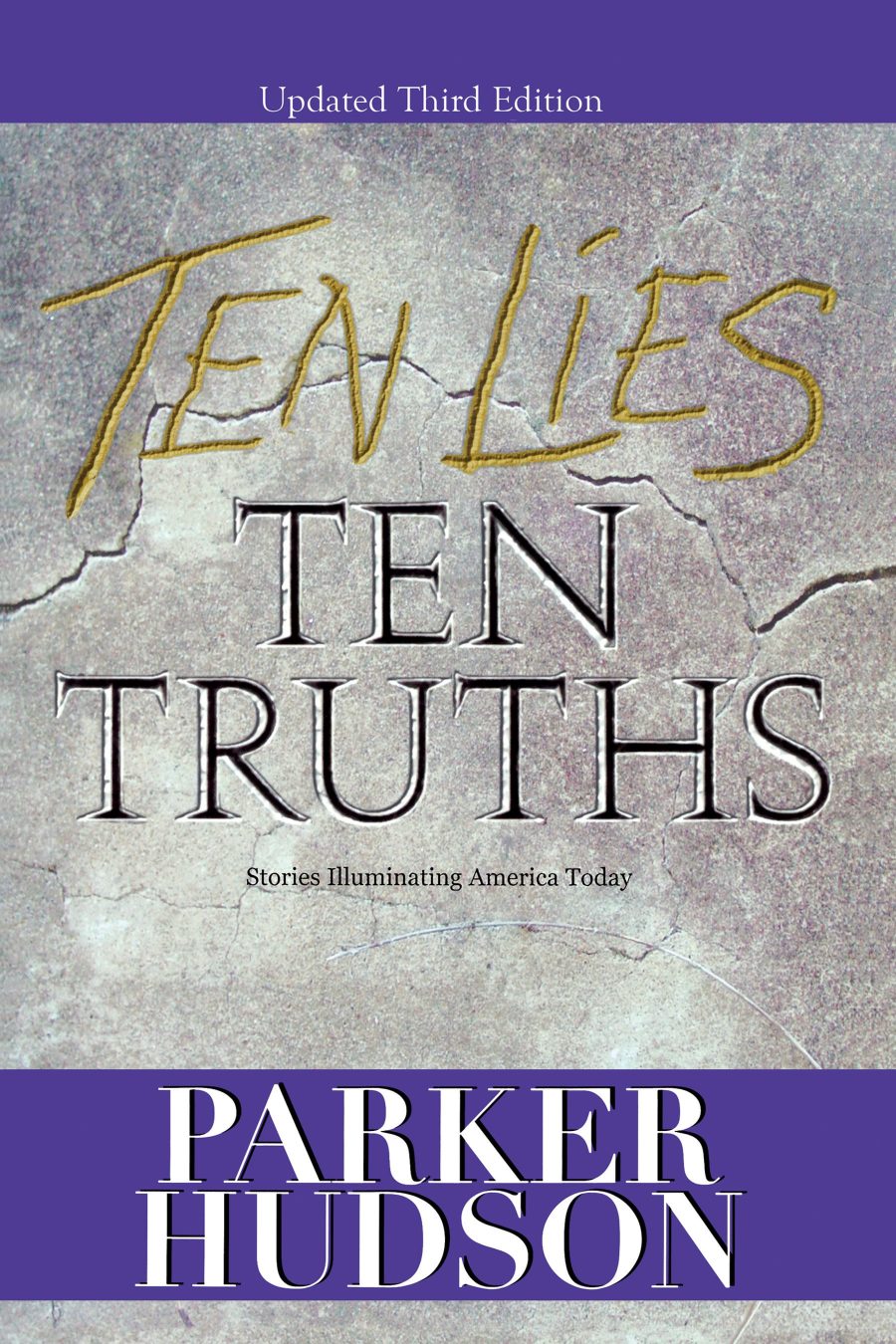

"TEN LIES AND TEN TRUTHS" - 3rd edition. Please tell us where to send your book.

Your Subscription

You are subscribing to future posts and newsletters. I value your privacy and would never spam you. You may unsubscribe at any time.

Please see our Privacy Policy:

Categories

Tags

Abortion

America

China

Christian History

Cooperation

Daughters

Debt

Deficit

Drugs

Economics

Employment

Europe

Evolution

Faith

Families

Fathers

Foreign Policy

Founding Fathers

Genders

Government

Healthcare

History

Islam

Jesus

Liberals

Living Well

Military Service

Nazis

Obama

Policies

Political Class

Progressives

Putin

Race Relations

Recent Events

Russia

Science

Sons

Taxes

Ten Lies and Ten Truths

Things We Like

Thugs

Transformation

Truth

Truth Has Consequences

My Favorite Resource Links

- Dispatches with John Biver

- Ken Boa

- Church of the Apostles

- Michael Youssef

- Bryant Wright

- MovieGuide-Ted Baehr

- Redeemer Church–Tim Keller

- Leading The Way–Michael Youssef

- Carmen Fowler LaBerge

- Socrates in the City–Eric Metaxas

- Eternal Perspective Ministries

- Wallbuilders

- Crums of Truth

- The Truth Project

- Family Research Council

Comments